“Pivot quickly” is not a directive that marketers in the financial services industry would call typical. In an old school industry, with no shortage of compliance guardrails and regulatory red tape, the directive is more like: “Turn this behemoth cargo ship 180° – slowly! – don’t let any containers fall off in the turning process”.

We’ve worked with many enterprise financial institutions on creating next-gen content strategies. Social media is the hardest distribution channel to re-strategize and implement for this category. The formats that served the financial industry well in the social media landscape of the 2010s (think: text graphics, infographics, long-format vertical video) simply do not have a chance of success with today’s social media algorithms.

Eliciting change on a full social media transformation is a marathon for the financial services industry, not a sprint. However, there are small changes that can give big results (quickly!), including shifting toward bite-sized financial content, a.k.a. “snackable content”. This type of social content has the ability to turn a complex topic into something that a social scroller can stop and watch for a mere couple of seconds and yet be more educated on the topic after watching.

What we learned for financial services social media content

When we think of a big win for content marketing in financial services, this is it. Social media has an enormous opportunity to create impact for businesses in the financial services sector. A survey commissioned by Forbes Advisor and conducted by market research company Prolific found that 79% of members of the millennial and Gen Z generations have gotten financial advice from social media.

Beyond just advice, social media can help audiences understand and navigate their finances, as another 76% believe financial content on social media has made it less taboo to talk about money.

In assessing the category leaders for financial services social media content, we find six learnings and best practices for you to implement in your strategy.

Spoiler alert: you are going to need a bench of content creators. The algorithms like faces. Let’s get into it!

79% of members of the millennial and Gen Z generations have gotten financial advice from social media

Click To Tweet

Learning #1:

Make complex topics more digestible with a two-way conversation style.

A volley-style conversation helps to break up a lengthy monologue. Using a question and answer format to tell two sides of a story with the same creator makes it simple to script and shoot with only one personality. Text overlays are important here for both sound-off viewing as well as a secondary comprehension method for more difficult subject matters.

The Washington Post has become expert in this type of content, which allows the media brand to get information out quickly on trending topics while also ensuring a general audience has increased comprehension of the topic.

The Biden administration announced Friday that it will forgive the student loans of more than 800,000 borrowers, wiping out $39 billion in debt.

♬ original sound – We are a newspaper.

Learning #2:

Use trending content types to get across one bite-sized message

These are your light-lift additions to the social calendar that can be done day-of for increased outputs. Keeping watch on trending formats across platforms and having a creator (or multiple!) at the ready on your social team allows for quick and easy content for your audiences.

Your audience wouldn’t be well-served if your entire feed was this type of content. It’s too surface level. However, it’s a great way to increase your social content and can be a secondary or tertiary level of detail on a specific content pillar or topic your editorial calendar is focusing on.

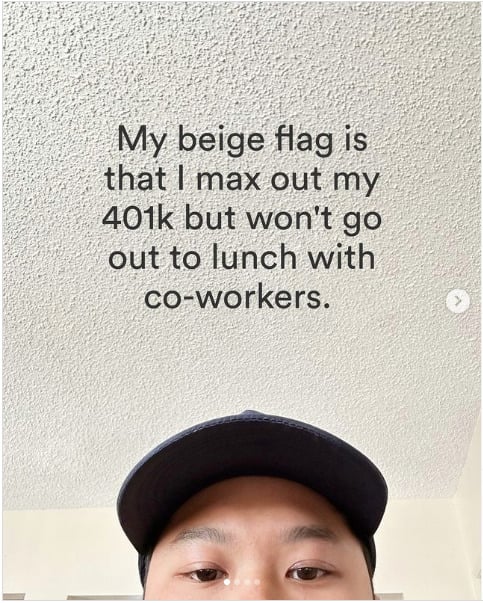

For example, Chime might have a longer form video piece on why Gen Z should take advantage of 401k matching, and then the below message is both relevant and timely and helps to increase the overall message penetration for the Gen Z and 401k messaging pillar.

Credit: Chime

76% believe financial content on social media has made it less taboo to talk about money.

Click To Tweet

Learning #3:

Use a “guide” in mini-campaigns

Marketing thought leader Donald Miller made popular the idea of having a “guide” in your brand story. It’s a classic movie arch analysis: your customer is the hero, the hero has a problem, your product or service is the solution, and they need a guide that helps them get from start to finish. Bite-sized financial services content is served well by this simple framework.

Fidelity is a great example of a brand personalizing the message by using a guide (in the example here, actual Fidelity advisor Blake McMurry) to help the audience understand the complexities of the stock market. This mini-series shows up about once per month in Fidelity feeds and fuels their stocks education topic pillar.

Credit: Fidelity

Learning #4:

Use familiar and friendly faces to build trust

Research has repeatedly proven that people trust people more than people trust brands. It’s why influencer marketing has been a reliable marketing tactic for a decade. As the cost of influencers has steadily increased, brands have smartly begun building in-house creator teams. This is not only a better use of resources, but the expertise of the internal teams shines through the content.

NerdWallet has a subset of writers that are consistently creating social content and feeding the financial content marketing beast. The brand is expertly branding each creator with a unique format type, editorial tone, and stylized assets.

Credit: NerdWallet

Learning #5:

Explain financial subjects in “best friend” language

When creating snackable content, whether for an end-customer audience or even on a specialized sub-group account (like a Linkedin Showcase page for a specific type of investor audience), you want to use language that you would use conversationally.

Script it like you are talking to your best friend (even better, your best friend who happens to not work in finserv!), not like you are talking at an internal marketing meeting. When it’s necessary to use finserv lingo, though, you can use visual aids on the video to help the average viewer grasp the concept quickly and simply.

Credit: morningbrew

Learning #6:

Use visual aids and text to reinforce specialized language

Whether mentioning a stat, reporting on a numerical value, or using hyper-specific financial lingo, using graphics or icons on the screen with your text overlay gives additional reference material for the viewer, and keeps the content engaging and fast-paced.

Bonus Insight for Social Content in Financial Services:

Shoot once, slice thrice.

The Forbes study also found that Reddit and YouTube are the most trusted platforms for financial advice. The examples shared here are mostly from TikTok and Instagram, but YouTube Shorts is another underutilized social media platform for the financial services industry.

Our best advice for creating bite-sized content is to repurpose across platforms. Shoot vertically, and slice the content 3 different ways for your Instagram Reels, TikToks, and YouTube Shorts platforms and unique audiences. This allows you to give your finserv target audience the content they want on the platforms they prefer, without over-indexing on net-new content for each platform.

For more insights on creating content for the financial services sector, check out our blogs.

The post Creating Snackable Social Content in Financial Services Content Marketing appeared first on Convince & Convert.